Article

The domestic content bonus credit explained: What manufacturers need to know

The Inflation Reduction Act (IRA) has fundamentally influenced investment priorities in energy generating properties across the U.S. market. Notably, domestic content bonus credit available for investment and production tax credits has catalyzed significant investments into the American supply chain. While these credits are typically claimed by project owners — often utilities companies — the success of such project’s hinges on a diverse ecosystem of manufacturing and installation companies. Therefore, manufacturers must proactively consider the impact of their decisions throughout the value chain and strategically identify avenues to outpace competition.

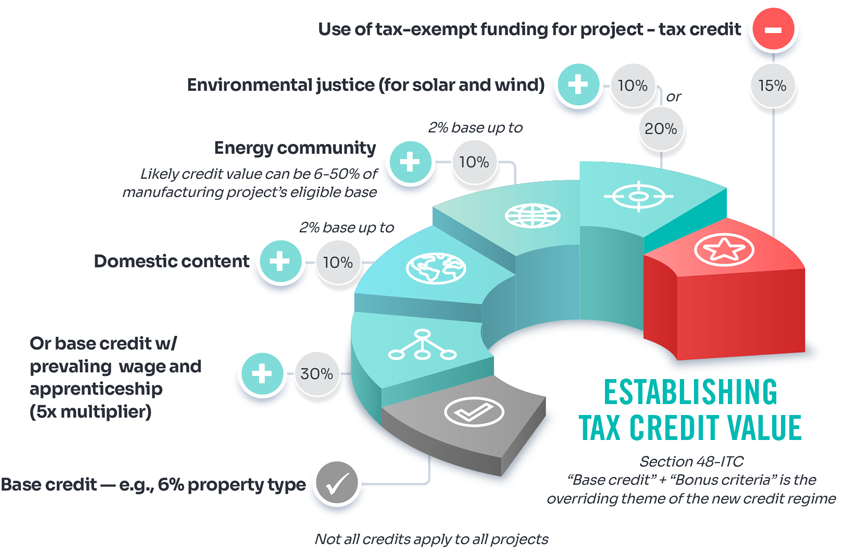

Manufacturers have distinct opportunities to claim credits for qualifying energy properties through the section 48C and 45X programs. It’s crucial to not only capitalize on these incentives but also remain cognizant of domestic content requirements, as illustrated above.

By strategically navigating these programs and aligning with domestic content regulations, manufacturers can optimize IRA benefits while simultaneously meeting the needs and expectations of customers.

Illustrative example

For a project owner seeking a credit, the domestic content bonus credit represents a potential increase of 10% in their investment in qualifying energy property under the section 48 tax credit. Let's illustrate this with an example: Imagine a $100 million project that is in the process of filing its tax credit application at the time of being put into service.

Under the section 48 investment tax credits, eligible properties span various sectors, including biogas, solar, wind, combined heat and power and geothermal, among others. These projects typically qualify for a base credit of 6%. However, if the project meets the prevailing wage and apprenticeship (PW&A) requirement, this credit is amplified by five times, boosting the value to a 30% credit. By adhering to the requirements of the domestic content bonus credit and siting the project where energy community initiatives are applicable can each add an additional 10%, creating a total benefit of 50%, or $50 million. Similarly, if the PW&A requirement is satisfied for section 45 production tax credits, a comparable credit structure applies, although with the base credit calculated per kilowatt-hour (kWh).

Key considerations

Given the substantial value involved (up to 10% for project owners), general contractors and project managers are entrusted with ensuring compliance with domestic content bonus credit requirements. This entails:

- 100% of structural steel and iron is domestically sourced.

- For projects commencing construction in 2024, a minimum of 40% of the total cost of manufactured products used in the project are domestically sourced, with annual escalations of 5% up to 55%.

While not all project components are mandated to be domestic, contractors and project managers will prioritize manufacturers capable of supplying domestically manufactured products to meet these crucial project thresholds. It is important to note that current Treasury guidance requires these percentages to be calculated off the manufactured cost of goods, not the owner’s cost. Necessitating enhanced collaboration between manufacturers and third-party firms tasked with confirming domestic content compliance.

Manufacturers should be thoughtful in marketing their domestic status, ensuring that any substituted materials or outsourced processes do not change to foreign vendors, even if for a temporary disruption such as a natural disaster or labor shortages. If such situations arise, the manufacturer must recalculate their domestic status and collaborate with customers to determine appropriate next steps.

What can be done to turn risk into opportunity?

The credits authorized by the IRA, which includes the domestic content bonus credit, are slated to sunset on Dec. 31, 2032. With nearly a decade of required compliance monitoring for customers, we advise manufacturers to establish a domestic content monitoring program to proactively manage this process.

Alternatively, manufacturers can choose to react to domestic content certification requests as they arise. However, without a structured process in place, this reactive approach could lead to weeks of compiling and reviewing information among internal stakeholders. Establishing a monitoring and reporting program will alleviate organizational burden by ensuring information is available on demand, thereby enhancing customer service.

By implementing an organized process, manufacturers can confidently highlight their capabilities during the sales process, thus transforming compliance obligations into opportunities for business growth.

Baker Tilly’s specialized IRA team is helping manufacturers take full advantage of opportunities related to energy tax credits and the domestic content bonus credit.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.